An operating agreement is a vital, but not constantly compulsory, paper for limited obligation companies. Here’s what to include when writing your LLC operating contract.

An LLC operating arrangement is a lawful file that describes the terms, guidelines, and structure of a limited obligation firm (LLC) according to its participants’ requirements. These papers define the company’s possession, management duties, earnings circulation, and various other key operational details.

Not every state requires LLC operating arrangements. Nevertheless, these contracts work in clarifying duties, securing participants’ passions, and making certain the business’s operations run smoothly. In this overview, we’ll examine the significance of LLC operating contracts and describe what must be included as required by state laws, along with for the benefit of your partnership.

Why every LLC needs an operating agreement

LLC operating agreements aren’t obligatory in every state, yet they are foundational to running a new business successfully.read about it North Carolina Limited Liability Company Agreement from Our Articles

Initially, it’s worth acknowledging the 5 states that call for operating arrangements by regulation: The golden state, Delaware, Maine, Missouri, and New York City. Even within this small group, the requirements vary. As an example, in Delaware, Maine, and Missouri, the operating contract can be dental, created, or suggested. New York mandates a created operating arrangement that is maintained internally but is not filed with the state. Testimonial your state’s rules concerning LLC formation to make sure you’re certified.

If you intend to start an LLC in any other state, you don’t require an operating arrangement, yet professionals strongly recommend developing one anyhow. ‘The major pros of an operating arrangement are that it protects an LLC’s participants from the responsibilities of the LLC itself, enhances clearness in just how the organization is structured and run, and gives versatility in that it can be adjusted to a details LLC,’ composed Thomson Reuters.

An operating contract aids you and your companions choose just how business will certainly run. If your LLC does not have an operating arrangement, the state’s default legislations apply. As an example, some states mandate that all participants must share earnings similarly, no matter just how much money each participant places in or owns. If you desire a various way to share earnings or other rules, your operating contract can set those up.

Operating arrangements clear up business setup in between several participants to prevent the risk of future disagreements or misunderstandings. ‘An operating arrangement ensures that each LLC participant has the exact same understanding of their rights and duties and agrees to exactly how choices and conflicts ought to be dealt with within business entity,’ composed LegalZoom.

Furthermore, LLC operating contracts give lawful security for participants’ personal possessions. These contracts formally separate your business and personal property and possessions. Because of this, any kind of business-related legal obstacles won’t affect your personal responsibility.

If your LLC does not have an operating contract, the state’s default laws apply. For instance, some states mandate that all participants have to share earnings equally, despite how much money each participant puts in or possesses.

What areas are consisted of in an operating contract?

Running arrangements don’t need to be long. The United State Small Business Administration suggests covering the complying with topics:

- The percent of participants’ ownership.

- Voting civil liberties and duties.

- The powers and tasks of members and supervisors.

- Circulation of profits and losses.

- Business conferences.

- Buyout and buy-sell rules (the treatments for transferring interest or in the event of a death).

At a minimum, make certain your LLC operating contract covers the adhering to topics.

Ownership, funding, and ballot

Utilize your LLC arrangement to clarify who has what, how much control each participant has, and just how capital and ballot rights influence company choices.

Register for our e-newsletter, Twelve o’clock at night Oil

Outline each participant’s possession share in the LLC, usually based on the funding or properties each person added. Ownership shares are shared in percentages. The contract ought to likewise specify who takes care of the LLC: participants or assigned managers and just how major choices are voted on, which develops clear administration from the outset.

Resources payments document just how much cash, residential or commercial property, or services each member adds to the LLC, developing their economic risk in the business. ‘Each partner might have contributed a specific amount of funding when they began the business, and it’s an excellent idea to videotape these quantities, as they might influence other aspects of the contract,’ wrote LegalZoom. ‘Detail the initial resources contributions of each member, which can be in the form of money, home, or services.’

Ultimately, establish voting rights, the voting procedure, and guidelines for passing resolutions. Generally, electing rights are proportional to possession percentages, however you can tailor these civil liberties for your company. Describe the treatment for including or eliminating new members, consisting of how the procedure impacts possession rate of interests and any other organization changes that require ballots.

Revenue allocations and distributions

Spelling out how the LLC’s revenues will certainly be shared and distributed will certainly assist stay clear of any type of conflict later. ‘LLCs use adaptability in how you can divide your business earnings. While frequently the percent of revenues specific participants obtain is straight pertaining to possession percent, you may choose a various plan would certainly be appropriate,’ composed SCORE.

Some LLCs determine revenue sharing based upon responsibilities; as an example, the individual that tackles a larger work takes even more of the revenue. The charm of an LLC is that you can create a revenue distribution system that functions ideal for you.

Administration roles and transfers

By default, LLCs are thought about ‘member-managed’ by state legislation. This suggests all participants participate in the daily procedures and decision-making of business. Nonetheless, your operating agreement can establish a manager-managed framework. In this variation, managers (who might or might not be participants) handle day-to-day procedures, while members concentrate on more comprehensive company decisions.

‘A manager-managed LLC can make sense for your organization if particular LLC members don’t plan to participate in decision making (normally relative or outside financiers),’ created the Wolters Kluwer law practice. ‘If the participants choose this alternative, the members will not have a say in common organization decisions created to assist achieve your organization’s objectives.’

Specify how the LLC will certainly be handled with time also. Your LLC running arrangement should set regulations on how participants can offer or transfer their possession risks, including constraints or the right of first refusal for existing participants. It’s also valuable to create a succession plan for service connection in case of the retirement or death of a participant.

State requirements for LLC contracts

As formerly mentioned, just five states need some variation of an LLC operating agreement. Nevertheless, each state has various other needs for creating an LLC.

‘Normally, these demands consist of picking a special service name, appointing a registered representative, and declaring Articles of Company with the proper state agency (typically the Secretary of State),’ wrote ZenBusiness.

Some business owners puzzle the LLC operating arrangement and the articles of organization. Articles of company are needed by states to legally create an LLC. This document includes basic company info, including the LLC’s name, address, registered representative, members/managers, and whether it’s member-managed or manager-managed.

Its key objective provides the lawful existence of the LLC. Somewhat, the operating agreement regulates the internal affairs of the LLC.

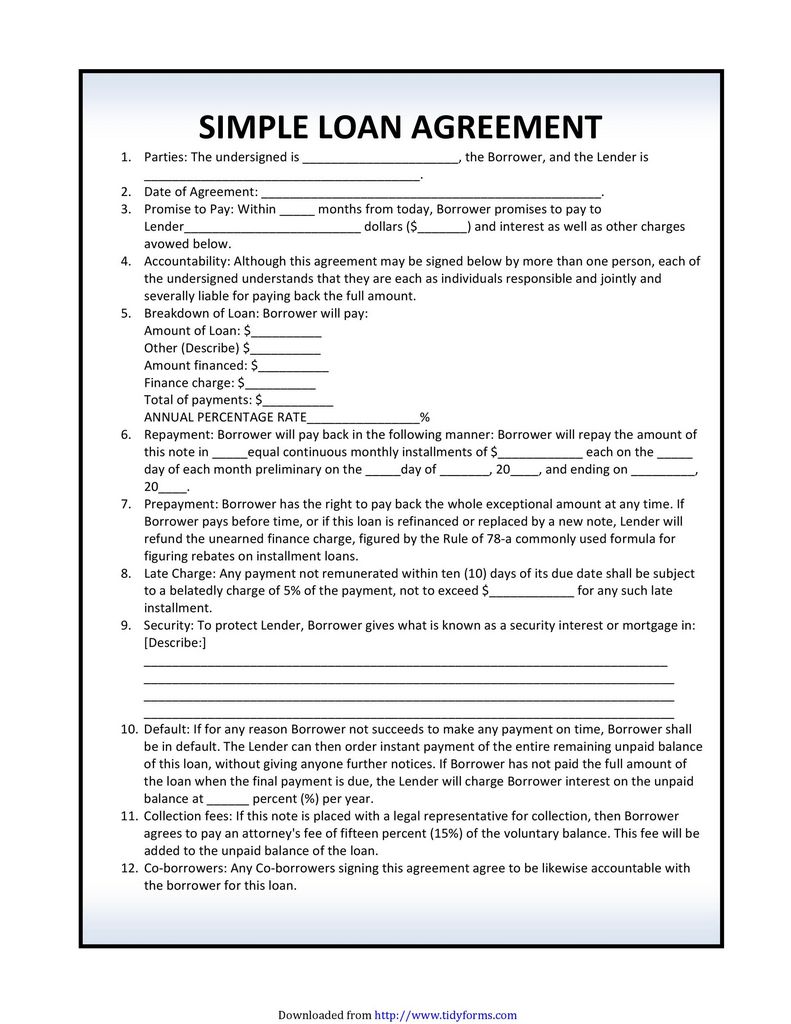

Templates for LLC operating contracts

There are dozens of totally free and paid layouts for LLC operating arrangements where to construct your very own. Try to find a template that consists of these elements:

- Firm development details, with vital information like participant names and the major office address.

- Capital contributions, such as clear descriptions of each participant’s initial financial investment.

- Ownership and earnings distribution defining ownership portions and exactly how earnings and losses are divided.

- The administration framework, such as whether the LLC is member-managed or manager-managed, plus the duties and duties for members or supervisors.

- The voting rights, procedures for meetings, and exactly how ties or predicaments will certainly be solved.

- Procedures for including new members, moving ownership, membership buyout, and member withdrawal.

- Conditions under which the LLC can be liquified and the procedure for settling financial debts or distributing properties.

It’s additionally advised that you consult with a professional who can aid you figure out exactly how to tailor the template for your business.

CARBON MONOXIDE – objectives to bring you motivation from leading respected professionals. Nonetheless, before making any type of company choice, you need to consult a specialist that can encourage you based upon your individual circumstance.