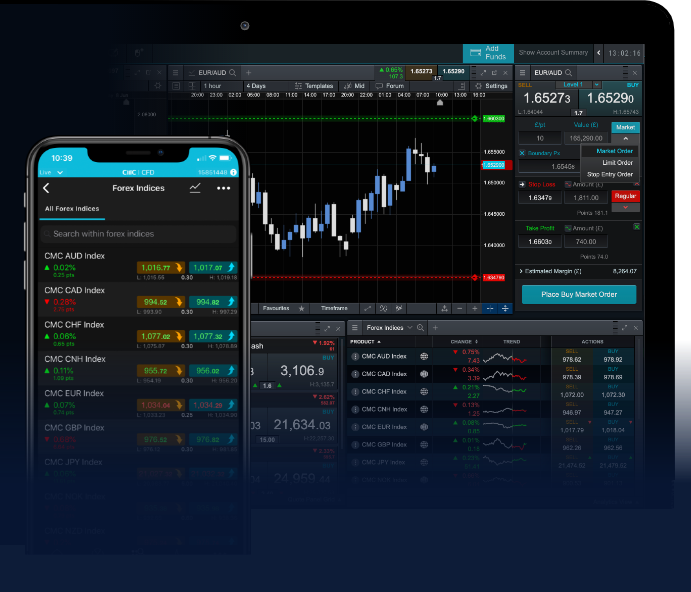

Forex trading signals are integral tools that traders utilize to navigate the complex world of currency exchange. By interpreting various market indicators, these signals provide insights into potential price movements in the forex market. Whether you are a novice trader or an experienced currency strategist, understanding and effectively using forex trading signals can significantly enhance your trading outcomes. For comprehensive guidance and to find the best trading opportunities, consider checking out the forex trading signals Best South African Brokers that offer tailored solutions for traders.

**What Are Forex Trading Signals?**

Forex trading signals are essentially trade ideas or recommendations generated by either human analysts or automated algorithms. They indicate when to buy or sell a currency pair based on technical and fundamental analysis. These signals can encompass diverse data points, including price levels, timeframes, and economic news releases. They act as a roadmap for traders, helping to simplify decision-making and improve trading outcomes.

**Types of Forex Trading Signals**

Forex trading signals primarily fall into two categories: manual and automated. Manual signals are often provided by experienced analysts through technical analysis methods, whereas automated signals are generated by trading algorithms that analyze market conditions in real-time.

1. Manual Trading Signals: These signals rely heavily on the expertise of the trader. Analysts examine charts, identify patterns, and interpret market indicators to provide trade recommendations. Manual trading signals can be highly beneficial as they incorporate human intuition and market sentiment, which can sometimes elude automated systems. However, they may also introduce subjectivity and bias.

2. Automated Trading Signals: These signals are produced by advanced algorithms that analyze vast amounts of market data instantaneously. Automated systems can identify opportunities based on predefined criteria without human intervention. The advantages of automated signals include speed, efficiency, and the ability to remain objective. However, they may lack the nuanced insights that a proficient trader could provide.

**How to Read Forex Trading Signals**

Reading forex trading signals involves understanding various components that signal a potential trade. Here are the common elements you might encounter:

- Currency Pair: The specific currencies being traded (e.g., EUR/USD).

- Entry Price: The price level at which to enter the trade.

- Exit Price: The target price for taking profits.

- Stop-Loss Level: The price level to limit losses if the trade moves unfavorably.

- Timeframe: The chart timeframe used for the signal (e.g., hourly, daily).

Understanding these components is crucial for executing trades effectively and managing risk. Traders should take the time to familiarize themselves with different signal formats to ensure they can act quickly when opportunities arise.

**Benefits of Using Forex Trading Signals**

Using forex trading signals can offer several benefits, particularly for those new to the forex market or those looking to enhance their trading strategies:

- Informed Decisions: Trading signals provide actionable insights that help traders make informed decisions.

- Time-Saving: Signals reduce the need for extensive analysis and research, allowing traders to focus on execution.

- Risk Management: By employing stop-loss and take-profit levels, traders can manage their risk effectively.

- Trend Identification: Signals help traders spot emerging trends, assisting in timing their trades accurately.

**Limitations of Forex Trading Signals**

While forex trading signals can be incredibly beneficial, they are not infallible. Some limitations include:

- Market Volatility: The forex market is highly volatile, and signals can quickly become outdated.

- Over-reliance: Traders may become overly reliant on signals without learning to analyze the market themselves.

- Quality Variability: Not all signals are created equal. Traders must evaluate the credibility of the source.

Hence, it’s paramount for traders to exercise caution and maintain a diversified approach to their trading strategies.

**Choosing a Reliable Forex Signal Provider**

When seeking forex trading signals, selecting a reputable signals provider is crucial. Look for providers that offer:

- Transparency: Clear information about their trading strategies, performance, and risk factors.

- Track Record: Evidence of past signal accuracy and reliability.

- Customer Support: Accessible customer service for queries and support.

- Trial Periods: Some providers may offer free trials, allowing you to assess their services without commitment.

Ultimately, combining signals with thorough research and personal trading strategies leads to well-rounded trading decisions.

**Conclusion**

Forex trading signals are valuable tools that, when used effectively, can enhance trading skills and improve performance in the unpredictable forex market. By understanding the different types of signals, how to read them, and the advantages they offer, traders can unlock new potential in their trading endeavors. Always remember, while signals can guide your decisions, incorporating comprehensive market analysis and personal strategies will provide the best chances for success in forex trading.